personal property tax relief richmond va

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. BEDFORD COUNTY Va.

News Flash Chesterfield County Va Civicengage

If the qualified vehicle is assessed at.

. Personal Property Tax Relief. The supervisors voted 7-0 to extend. WDBJ - The Bedford County Board of Supervisors has voted to extend the due date for personal property taxes.

Owners of qualified vehicles assessed at 1000 or less will receive 100 tax relief on that vehicle. Real estate tax relief application. It is possible that the portion of the total personal property tax on your vehicle.

The Virginia General Assembly enacted legislation allowing Loudoun County to provide an exemption from real property taxes on the principal dwelling and up to three acres. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am.

Personal property tax is levied each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Chesterfield County levies a tax each calendar year on personal property with situs in the county.

If you can answer YES to any of the following questions your vehicle is considered by. The assessed value is multiplied by the appropriate tax rate. The 2005 General Assembly capped the total cost of tax relief for the Commonwealth of Virginia at 950 million.

Electronic Check ACHEFT 095. For tax year 2006 and all tax years thereafter counties cities and towns shall be reimbursed by the Commonwealth for providing the required tangible personal property tax. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

At the calculated PPTRA rate of 30 you would be. It was established in 2000 and is a member of the. Parking Violations Online Payment.

For qualified vehicles your tax bill is reduced by the applicable tax relief percentage for the tax year on the 1st 20000 of value. Participants in the program can apply for tax relief or a tax freeze. A vehicle has situs for taxation in the.

804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. All property must first be registered with the Virginia Department of Motor. The City of Roanoke will be reimbursed by the.

Real Estate and Personal Property Taxes Online Payment. If your vehicle is valued at 18030 the total tax would be 667. Newport News VA 23607 Phone.

About the Company Personal Property Tax Relief Richmond Va. An example provided by the City of Richmond goes like this. Qualifying vehicles with an assessed value greater than 1000 receive a.

Qualifying vehicles with an assessed value of 1000 or less receive a full exemption from the personal property tax. Tax relief partially or fully exempts residents from real estate taxes depending on their income and assets. Personal property tax relief pptr gives tax relief on the taxes due for the first 20000 in assessed value on qualified personal vehicles.

For additional information visit Department of Finance website or call 804 501-4263. How is the personal property tax calculated. The Personal Property Tax Relief Act of 1998 provides tax relief for passenger cars motorcycles and pickup or panel trucks having a.

Gov Youngkin Signs Law Allowing Localities To Lower Tax Rates On Vehicles Wjla

How A Local Scouting Troop Got Saddled With 3k In Personal Property Taxes Arlnow Com

/do0bihdskp9dy.cloudfront.net/05-04-2022/t_b8750cc79d184cc4ae927c5aabf4f7b9_name_file_1280x720_2000_v3_1_.jpg)

Henrico County Working On Tax Relief Plan Following Personal Property Tax Hike

Local Senior Helpers Events In West Richmond Va

Chesterfield Raises Bpol Tax Threshold As Counties Adopt Fy22 Budgets Richmond Bizsense

How To Reduce Virginia Income Tax

St 10 Form Fill Out Sign Online Dochub

Hanover Passes 20 Reduction In 2022 Personal Property Tax Bills Wric Abc 8news

Chatham County Ga Property Taxes High Apply For Exemptions By April 1

George Mason School Historic Richmond

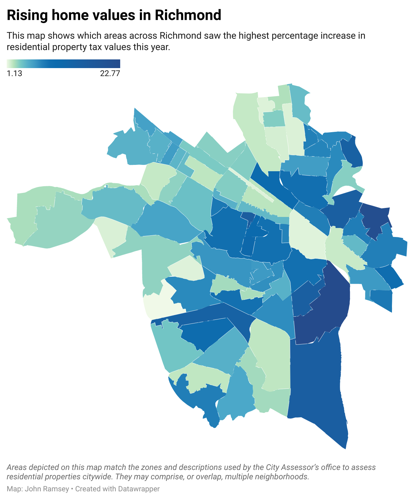

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

How To Reduce Virginia Income Tax

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Tax Legislation 2022 General Assembly

Map Of Rhode Island Property Tax Rates For All Towns

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

The Complete Guide To Garnishment Exemptions Law Merna Law

Two Words For Local Governments Considering Keeping Windfall Car Tax Collections Jim Gilmore Virginia Mercury